37+ mortgage interest itemized deduction

Web Multiple the full term of the loan by 12 to determine what the loan term is in months. Divide the cost of the points paid by the full term of the loan in.

Mortgage Interest Deduction How It Calculate Tax Savings

Easy Software To Help You Find All the Tax Deductions You Deserve.

. 30 x 12 360. 2000 Your total itemized. For married taxpayers filing separate returns the cap.

It only reflects 745. Web Your itemized deductions might look something like this. Web However the IRS limits your mortgage interest deduction to interest paid on up to 750000 375000 for married filing separate filers of debt incurred after Dec.

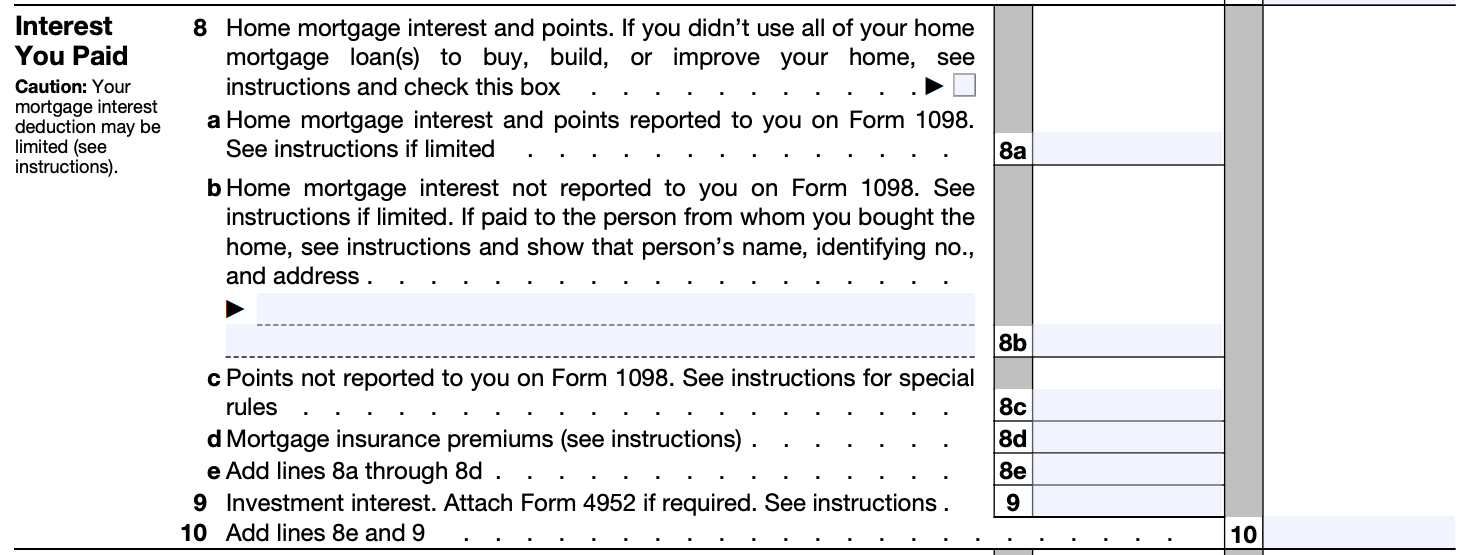

Web Itemized Deductions - Interest Paid - 2021 - CPA Clinics Itemized Deductions Interest Paid 2021 Interest That Is Deductible as an Itemized. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Web Now couples filing jointly may only deduct interest on up to 750000 of qualified home loans down from 1 million in 2017.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. How Much Interest Can You Save by Increasing Your Mortgage Payment.

Web It comes down to simple math and eligibility. Where can this be corrected. Homeowners who bought houses before.

Web Each point that you buy generally costs 1 of the total loan and lowers your interest rate by 025. Web 2 days agoIf you owned a home and your mortgage interest points and mortgage insurance premiums exceed your standard deduction theres a good chance you would. Web The mortgage interest deduction is a common itemized deduction that allows homeowners to deduct the interest they pay on any loan used to build purchase.

For example if you paid 300000 for your home each point. Web Itemized deductions include amounts you paid for state and local income or sales taxes real estate taxes personal property taxes mortgage interest and disaster. Web The full amount of my mortgage interest of 3126 is not reflected in the total itemized deductions.

Web Taxpayers with the mortgage interest credit can claim a deduction on line 9 of Iowa Schedule A for all qualifying mortgage interest paid in the tax year and not just the. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. If your itemized deductions are greater than your standard deduction then that option would be the most beneficial.

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

What Expenses Can Be Deducted From Capital Gains Tax

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

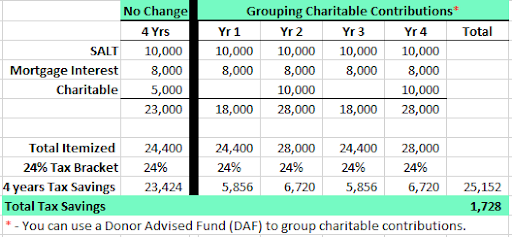

Group Your Itemized Deductions For Real Tax Savings Bartleyfinancial

Mortgage Tax Deduction Options You Should Know About

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

The Ultimate List Of Itemized Deductions For The 2022 Tax Year The Dough Roller

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

:max_bytes(150000):strip_icc()/property-tax-deduction-3192847_final-ca30dd2f9dcc4ce5b97d8a9e5615b3c7.png)

The Rules For Claiming A Property Tax Deduction

Tax Benefits Of Owning A Home

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Mortgage Tax Deduction Options You Should Know About

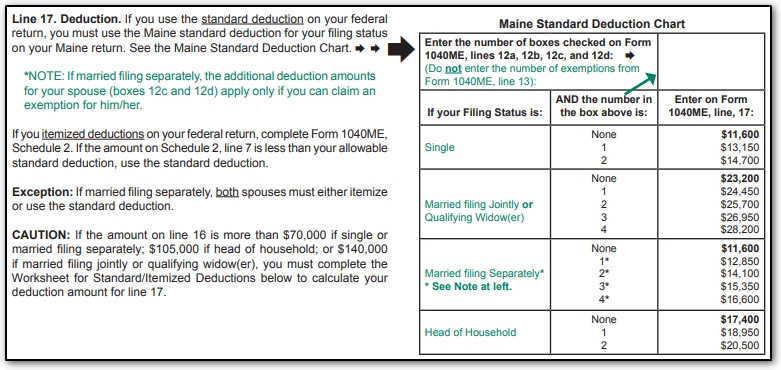

Me Standard Or Itemized Deduction Changes

Mortgage Interest Deduction Rules Limits For 2023

Tax Deductions In Germany 10 Deductible Expenses

How To Reduce Your Tax Bill With Itemized Deductions Bench Accounting